What will the future hold if they do?

Disclaimer: This is my opinion and should not be taken as fact as I am only going by my experience in Real Estate over the last 40 years.

In 2023 I saw a few things happening that we have not experienced in a very long time. Homeowners saw the rising mortgage rates as a reason to “lock-in” and stay put and not sell. This caused a lower inventory of homes coming to market. Home buyers saw rising rates and caused them to take a second look at buying and lowered their buying power. Some buyers also decided to stay put or wait for lower home prices and or rates. Lower inventory of homes coming to market and lower inventory of buyers caused the demand and supply to equalize and kept home prices from falling.

There has been a lot of talk of mortgage rates dropping lately. We are noticing some signs of a rebound in demand as both buyers and sellers are getting climatized to the current rates. I think if rates drop, homeowners who wish to upsize, or downsize will put their homes on the market, and buyers will return causing demand to rise as well as prices. Although not as much as we saw during the pandemic. However, if rates continue rising, more homeowners will lock in rates and stay put. First time home buyers will have a difficult time buying and will be forced to lower their expectation or look at renting till inventory picks up again. Buying a home with rising interest rates will depend on each persons buying power and financial situation.

History seems to suggest that mortgage rates only need to stabilize to fuel increased home sales. In other words, a return to pandemic-era low mortgage rates may not be necessary to impact sales activity. Once consumers settle into a new normal, we could see transaction volume increase in both buyers and sellers.

History shows that this is a repeat of the late 1970’s to early 1980’s.

In many ways, today’s housing market mirrors conditions in the early 1980s. It started in the early ’70s, when baby boomers became of age and started buying homes as they married and started families. Much like millennials today who have led the homebuying boom during the pandemic!

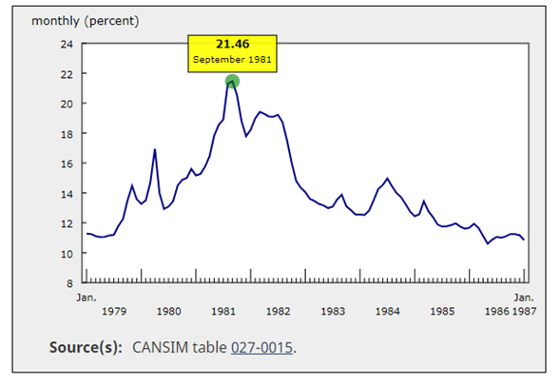

Back in the early 70’s home prices started to rise because demand far exceed the supply of existing homes coming to market. This demand lasted till the early 80’s as interest rates rose to a high of 21%. The Federal Government during that time was trying to control inflation by raising interest rates. Home sales declined by almost 50% from 1978 to 1982, and then prices became flat.

During a 10 year period rates went from 11% to 21% from 1979 to 1981. Then dropped from 21% back down to 11% from 1982 to 1988. See the graph below.

Mortgage rates only came down about two percentage points before existing-home sales picked up again, even though they had been about eight percentage points lower four years earlier. However, there’s a key difference in today’s housing market: Home prices are much HIGHER compared to the early 80’s.

Other factors to consider are that the percentage of mortgage debt is far greater today compared to back then. Also consider that in the 1980’s it was common to purchase a home with an assumable mortgages also assisted in the sales activity that we do not see available right now.

For those of you who do not know what an assumable mortgage is, in simple terms it is a mortgage that can be assumed by the buyer from the home seller. Back then if you had an assumable mortgage on your home at say at 10% and rates were at 18% it was a selling advantage to offer it to the buyer instead of them arranging a new mortgage. In some cases, buyers would take a second mortgage at a higher rate as well as the assumable mortgage in order to be able to buy the home.

Today we have a situation that rates are actually low compared to 1980’s and prices are high.

The fact that some home owners “locked in” rates may have different effect on the Real Estate market compared to the 1980’s. Homeowners may start to feel “locked in” and may avoid selling all together. Couple that with high home prices and some people will be reluctant to move, especially young families.

Another factor that will have an impact on housing prices will be the growing influx of immigration. Canada and Manitoba specifically is seen as a safe place to live and grow a family. With this growth in population, pressure to buy from the millennials, and lagging supply will continue to fuel the demand to buy a home.

The Bottom Line

If history is an indication of the behavior of sellers today, we may start to see existing-home sales increase gradually alongside falling mortgage rates. But too many factors are at play to determine with accuracy whether sellers will return to the market in 2024.

If mortgage rates fall enough early in the year, demand could rebound quickly, pushing prices even higher. But there’s still the possibility that a deep recession and rise in unemployment could lead to an influx of new supply from distressed sellers and more price reductions. Many experts expect conditions to hold steady in 2024 until mortgage rates fall again in the future.

If you are thinking of buying or selling a home, call me to discuss how I can help you.

Tony Rinella – Ethos Realty

B.A. Urban Studies (1981)

204-771-3866